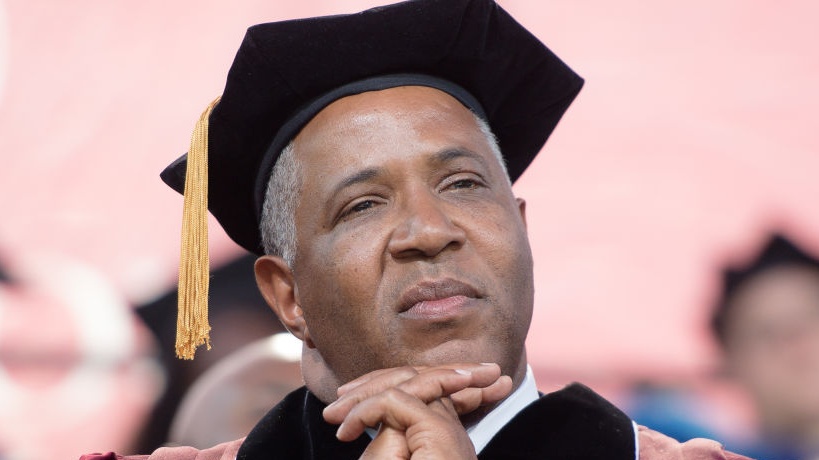

Robert Smith, who recently vowed to cover student loans for Morehouse graduates and one of the few Black billionaires, is accused of hiding $2 billion from the IRS.

In an agreement with the Justice Department, Smith admitted to his role in a tax evasion scheme that involved a number of other extremely wealthy people. He agreed to pay the government $139 million and abandon $182 million in charitable contribution deductions in a wide-ranging deal that may also include further government cooperation.

The Justice Department released a statement explaining that Smith created two shell companies in Belize and Nevis in 2000 that he routed millions into as a way to avoid paying taxes on it. Shell companies are known to be used by wealthy individuals in an attempt to conceal income and tax avoidance, according to Business Insider.

He ran the scheme until 2015, and the IRS said it allowed him to hide more than $200 million from the IRS. With the extra money, Smith admitted that he bought a vacation home in Sonoma, California, and two ski resorts in France.

He also used some of the untaxed money to rebuild his home in Colorado and "fund charitable activities at the property." Smith made headlines last year when he donated $34 million to Morehouse College to cover the student loans for the entire 2019 class, as Blavity previously reported. It's unclear if the accusations will have any effect on his pledge to the graduates.

"It is never too late to do the right thing. It is never too late to tell the truth. Smith committed serious crimes, but he also agreed to cooperate. Smith’s agreement to cooperate has put him on a path away from indictment,” U.S. Attorney David L. Anderson said in a statement.

After weeks of criticism for not going after wealthy tax dodgers, the IRS and Justice Department have also opened an investigation into Texas billionaire Robert Brockman.

Brockman was indicted on 39 counts the same day and like Smith, was hiding funds in Nevis and Bermuda as well as Switzerland, according to the Justice Department.

Both the IRS and Justice Department have faced massive criticism in recent years over a series of stories that have emerged showing that billionaires have found ways to avoid paying taxes and that the IRS targets low-income Americans more harshly.

Humphreys County in Mississippi, one of the country's poorest areas, was found to be the most audited county in America by ProPublica last year.

The New York Times revealed last month that President Donald Trump, a self-proclaimed billionaire, paid $750 in federal taxes in 2016 and 2017. Trump paid no federal income taxes in 10 out of 15 years beginning in 2000.

Two economists, Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley, reported that 2018 was the first time in history that the country's richest billionaires paid lower tax rates than the average person in the working class.

According to their book “The Triumph of Injustice,” the bottom half of all households in the United States paid on average a 24.2% tax rate while the top 400 richest families in the country paid an average rate of 23%.