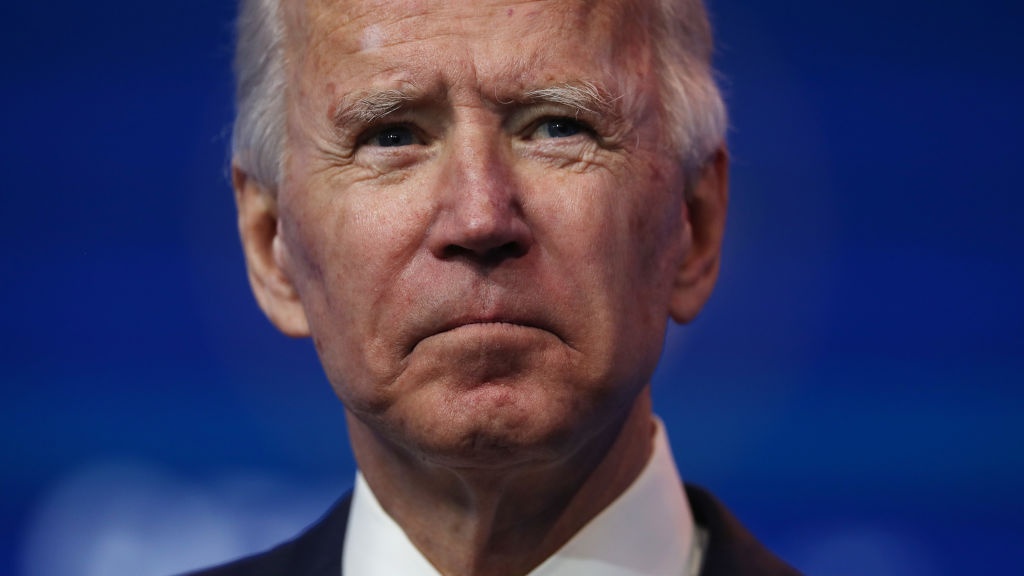

It looks like President-elect Joe Biden will be putting the racial wealth gap in his crosshairs once he takes office, thanks to new additions to his transition team.

Bloomberg reported on Sunday that Biden was adding racial wealth gap experts like Michigan State University economist Lisa Cook, University of California professor Mehrsa Baradaran, among many others to the "landing team" that will be involved with the Federal Reserve and banking and securities regulators.

Both Cook and Baradaran are well known for longstanding work on economic inequality and will join a group of nearly 500 experts who will look into how the country can address the massive gap in wealth between Black and white households.

Others who will be joining the team include former Obama administration official Don Graves, Hope Credit Union chief executive Bill Bynum and Tene Dolphin, the first executive director for the Greater Washington Black Chamber of Commerce.

On Monday, the U.S. Census Bureau

released alarming data that showed in 2017, white households had a median household wealth of $171,700, while for Black households it was $9,567.

The Census released new figures on the wealth gap today. The general trend remains the same, but seeing the numbers always staggers me: White households had a median household wealth of $171,700, compared with $25,000 for Hispanics and $9,567 for Blacks. https://t.co/AS1xXJwHT2

— Rachel Swarns (@rachelswarns) November 16, 2020

Anna Gifty Opoku-Agyeman, co-founder of the Sadie Collective, a nonprofit that strives to bring more Black women into economics, lauded the appointments in an interview with Bloomberg.

“It’s an incredible signal to the Black community. This administration is going to be focused on thinking about: ‘How do we build up Black wealth? How do we close this racial wealth gap?’" Opoku-Agyeman said. "Having these individuals who are representative of their community in the actual room where they can voice their perspective and have their perspective actually translate to policy — it matters more than you think.”

The COVID-19 pandemic has exacerbated racial wealth disparities in a number of ways. Black communities have been disproportionately affected by the virus in terms of deaths, infections and economic impact.

As Blavity previously reported, Black business owners have said they were shut out of the federal programs designed to keep businesses afloat during the pandemic, with some financial experts telling news outlets that it was possible upwards of 95% of Black-owned businesses were being shut out of the Paycheck Protection Program in April.

"Based on how the program is structured, we estimate that upwards of 90% of businesses owned by people of color have been, or will likely be, shut out of the Paycheck Protection Program," said Ashley Harrington, director of federal advocacy and senior council for the Center for Responsible Lending.

"Roughly 95% of Black-owned businesses, 91% of Latino-owned businesses, 91% of Native Hawaiian or Pacific Islander-owned businesses, and 75% of Asian-owned businesses stand close to no chance of receiving a PPP loan through a mainstream bank or credit union," a report done by the Center for Responsible Lending showed.

Due to the lack of help, 41% of Black businesses in the country closed permanently between February and April, and many more have since shut their doors.

The 500 experts that Biden is bringing on board have collectively said that they will focus on ways to address problems like healthcare, small business lending and housing as part of their work.

Both Biden and Vice President-elect Kamala Harris have made diversity a key part of their transition team building, making sure that half of all employees are women and about 40% are of other minority groups, as Blavity previously reported.