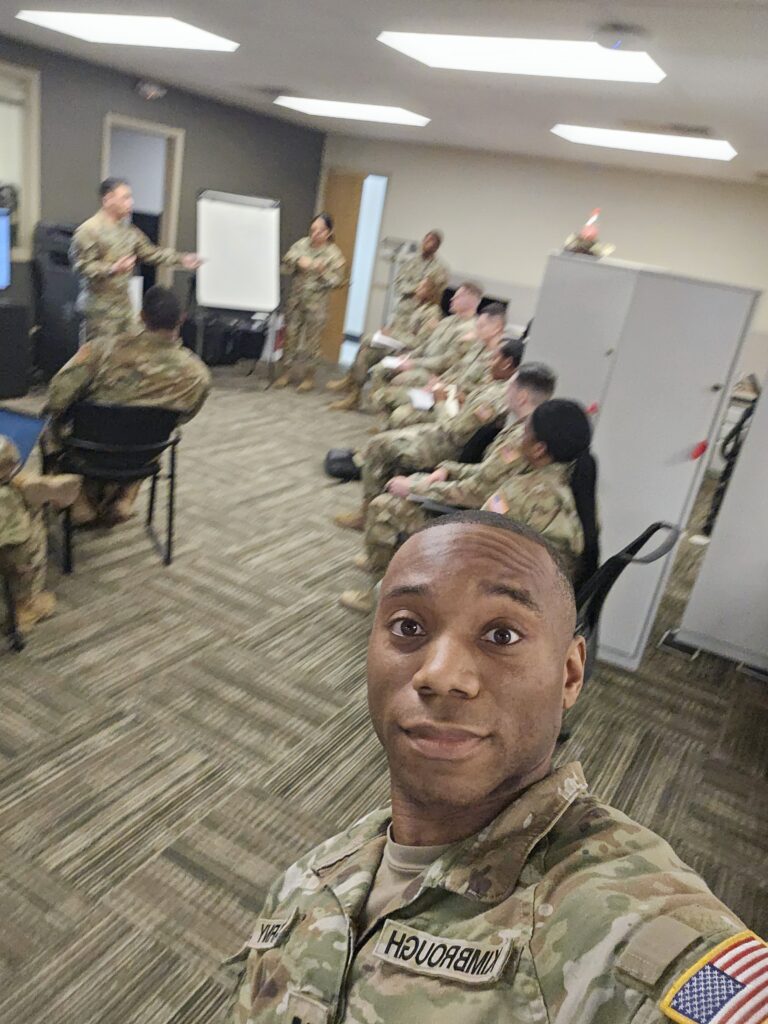

There are two kinds of people in this world: Those who work just to make money and those who make their money work for them. Dominique Kimbrough is someone who falls in the latter category. Carving out a niche space for himself in the world of financial literacy, the active U.S. Army Captain found his purpose in helping people understand money management. These were skills he refined over time.

Before joining the Army, Dominique had a pretty limited grasp on financial literacy. Still, he recognized its importance at a very young age. It was actually Dominique’s mother who helped him set up his first bank account, and taught him the basics about credit cards and investing.

“[She] was the cornerstone of my immediate family; everybody went to her,” he explains. “We don’t really come from much—my mom didn’t have much when I was growing up. So we just had to learn. And I had to learn from her.”

When the information Dominique’s mother offered prompted new questions that she couldn’t answer, he would do his own research.

“Information is power,” explains Dominique, who has always felt very strongly about sharing information. For him that looks like being intentional about passing down the knowledge he’s acquired and becoming a social media advocate for financial literacy. He specifically creates content about the tools that can be used by both active duty Soldiers and veterans—as well as everyday people—to navigate through tough times, eliminate debt, invest in the market or through ownership, and secure a future for their family.

But much of the information Dominique shares can be applied to all walks of life; some even regardless of age.

Case and point: “Delayed gratification,” he offers. “We kind of live in this world where people want things to happen right now. But in the Army, you learn that sometimes you gotta wait. And good things will come if you do. That also applies to money: when you invest, you don’t always get the return right now. Sometimes you have to wait a year, sometimes you have to wait five years.”

If planning out your financial future is a priority to you (spoiler alert: it needs to be), Dominique offers three vital tips:

1. Find a Mentor: Or maybe even two. Identify at least one person in your life who can offer financial guidance based on both their level of financial literacy and expertise, and their knowledge of your lifestyle or industry. That could even be someone within your own company or organization, as it has been for Dominique since his days in the Officer Training program.

2. Get Familiar With The Resources & Programs Available To You At Work: Whether it’s a 401k, a Health Savings Account, or access to financial education, most companies nowadays offer their employees resources that make budgeting and financial planning a little easier.

3. Plan Backwards: “The Army is really big on backwards planning,” he says. “And I think that’s a great approach to retirement planning as well. Set a goal for the amount of money you think you’ll need once you stop working, and build your plan backwards from there.”

And, when should you start? Dominique suggests prioritizing financial planning as early as you’re able to set aside a budget outside of your living expenses.

However, it’s not something you have to figure out alone. For example, in addition to Army Community Service classes, the U.S. Army offers Advance Pay—a 0% interest loan which is paid out against a Soldier’s salary when they complete Permanent Change of Station, and is deducted out of their paycheck over the course of a year. For those in a tighter financial position, or dealing with a crisis, there is an Army Emergency Relief program that will provide an interest free loan or grant to help navigate that challenge.

“The programs are there,” Dominique says. “The options and the opportunities are there.”

From career growth to creative pursuits, the Army is full of unexpected stories. Visit our content hub to meet the people who are redefining what service looks like.

For more information on the ways in which the U.S. Army can support your financial literacy and planning goals, visit GoArmy.com/benefits/while-you-serve.