Living in New York City, it's very hard not to get overwhelmed with the lifestyle. It's even harder trying to work a full-time job, live on your own, and maintain a decent social life. Everywhere and every day there is something to do, and even with as many "free" and "cheap" events as there are, things can get pricey. You get into a free event but spend $10-12 dollars per drink. You get into a free event WITH free refreshments but its first come, first served and you're not guaranteed a good time. Getting all options is damn near impossible – unless its an annual summer barbecue you know for sure will come in handy. But summer doesn't last forever, and neither do the high number of free events. As it gets colder, so do your pockets.

Photo: MemeCenter

I've been living in New York for twelve years and whenever someone visits or moves here, I try my best to pull them away from the shiny tourist life. Don't get me wrong, I love New York and the things that come with it (well, most of them). But living here and visiting here are two completely different things and it's pretty easy to get distracted from your main focus. Unless you have no kids, no spouse, no car, no care for sleep, and a job paying you 50-70k a year, it's nearly impossible to work full time, go out everyday after work, explore the city and all the events on weekends and holidays, travel 2-3 times a year, and still live below your means. What a lot of people also don't understand, is the more money you make, the more responsibilities you have. Not to say that you will never make enough to be comfortable, but let's be honest here: You MAKE more = You PAY more.

Photo: Pinterest

Now, I don't fall into most of the categories listed above, but I still do have responsibilities and bills that make it challenging to have a perfect sleep, socializing, working, and dreaming schedule. Though not impossible, it takes dedication, time and sacrifices to achieve that status. Some days you have to sacrifice spending money and socializing to work on your goals and dreams. Some days you have to sacrifice sleep to push yourself to work harder. Other days, you have to learn to sacrifice work to get rest – nothing good comes from being overworked all the time. While some days you have to put things aside to make time for others in your life. Sometimes you even have to debate between being happy with your dream job or being happy with a higher salary. A part of these sacrifices includes working and living on a budget until you can live well below your means. One major sacrifice I've made while living here is not traveling as much as I would want to. Though I haven't perfected budgeting and can definitely improve some, I've picked up a lot of tips while working that help both short and long term whether you have a part-time or full-time job.

These tips will help whether you live alone and survive check to check, if you're just starting out, or if you've got it a little more figured out.

1. Keep track of your weekly/biweekly hours and pay (whether you’re PT or FT).

2. Estimate how much you will get paid every pay cycle.

3. Keep a budget notebook that lists all of your important monthly expenses (rent, bills, transportation, groceries, etc).

4. Include the total for each upcoming bill.

5. Before each paycheck, subtract all the important expenses from your estimated total.

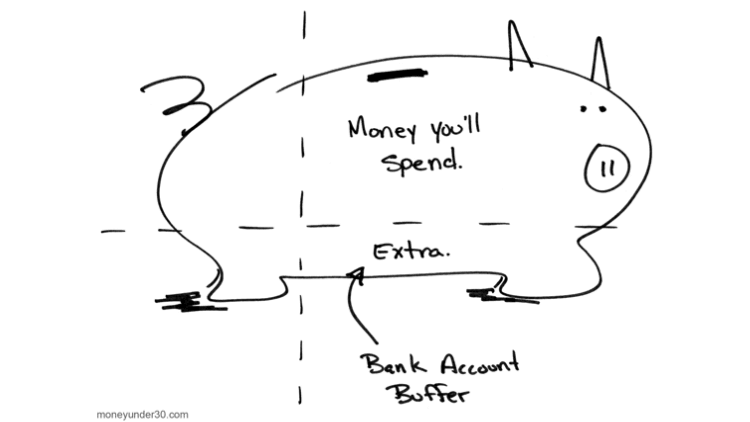

Photo: Moneyunder30.com

6. After you have accounted for all the bills, take away a percentage for savings and “extracurricular expenditures”. This will include going out, any extra items you need for a specific occasion, for work, or just to hold you over until your next payday.

7. Be consistent with how much you save, even if it’s as little as $5/$10 per check.

8. With the remainder, if any, either add it to your savings, keep it as “buffer money” or put it towards a dream. Whether that be a car fund, a travel fund, college fund, moving fund – something you can work towards.

"Buffer money" is definitely something important when budgeting as something unexpected is always bound to pop up. Living in New York, that's a high possibility with last minute needs, last minute challenges, last minute visits, last minute finds, and last minute events. It may be the "Concrete Jungle Where Dreams Are Made Of" but it can be a long road to get there if you aren't thinking smart. For all those new to the city, even though it will take some getting used to, definitely enjoy all the perks (there's A LOT). And for the experts, New York can certainly be livable and enjoyable at the same time – even if it takes time and money management.

P.S. Y’all better not be out here going broke trying to impress people. If that’s the case, pack up your things and come impress me.