If you’re interested in sharing your opinion on any cultural, political or personal topic, create an account here and check out our how-to post to learn more.

Opinions are the writer’s own and not those of Blavity's.

____

For those keeping up with current trends, NFTs (or “Non-Fungible Tokens”) have become a ubiquitous part of daily life. The (cryptocurrency) ethereum blockchain (think bitcoin) supports NFTs, which store extra information such as content and metadata. A completed transaction added to the ethereum blockchain is permanent and verifiable, and cannot be altered.

NFTs are, in essence, digital collector’s items. By virtue of being built on the same blockchain technology as cryptocurrencies like bitcoin, they act as a certificate of authenticity for whatever non-tangible item is being sold or traded, giving the buyer proof of ownership that can be verified and traced through the NFTs blockchain ledger.

Artists, entertainers and pop culture celebrities are looking to capitalize on this digital phenomenon by selling unique digital items to add to their revenue streams. New NFT inventory is announced daily, and transactions for staggering sums of money are becoming a common occurrence. NFTs have risen from humble beginnings as the format gained in popularity. In October of 2020, Jim Jones became one of the first rappers to sell an NFT — a digital version of one of his chains (jewelry, not block!) sold for $4,500. Since then, artists like Soulja Boy and Snoop Dogg have gotten in on the trend, with sales that are increasing in value, and many other household names in rap are not far behind.

After a challenging year for the music industry, with artists unable to generate income through live performances, it comes as no surprise that the NFT boom has emerged as an appealing way to generate revenue. But despite the cutting-edge technology behind NFTs, even the biggest names in music will find that they can’t evade traditional music copyright rules to enter the market. The bottom line is that when it comes to the sale of songs or albums, copyrights still apply. Where it gets a bit muddy is that NFT creators can keep certain copyrights while selling ownership rights. These ambiguities could lead to litigation.

Let’s focus on music for a second and how copyright laws can apply to NFTs. It is typical for artists to transfer partial ownership of their music rights to the parties who help them create and publish their music, whether that be their labels, producers or others. For this reason, should those artists or any other rightsholder look to sell an NFT comprised of a song or songs, they would need the explicit permission of any such parties with shared rights (licensing, mechanical, performance, sync, etc.) in order for the sale to be legally valid.

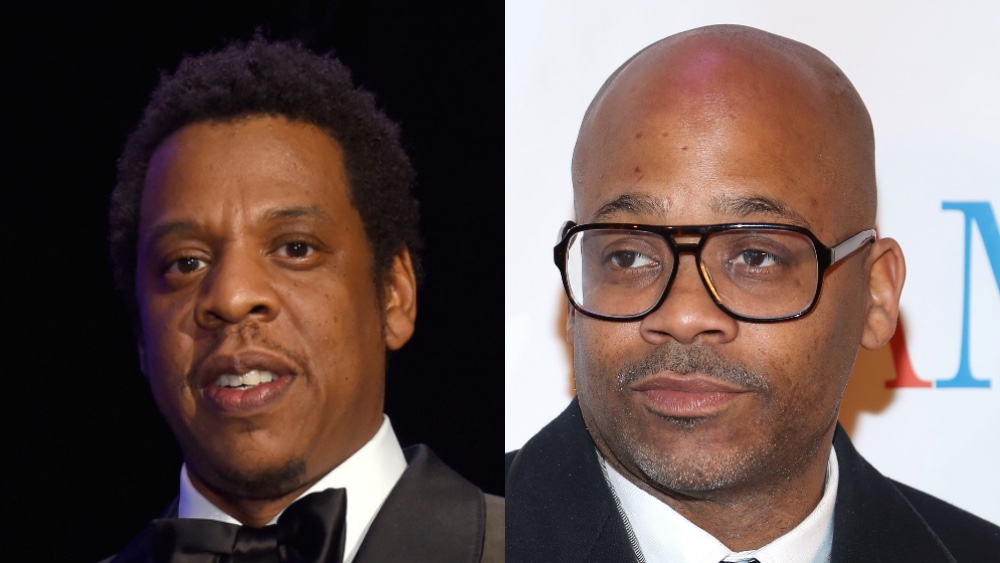

In one such example of the murky waters surrounding NFTs and copyrights, it was recently reported that Damon Dash planned to auction off an NFT of Jay-Z’s first album, Reasonable Doubt, on the cryptocurrency platform SuperFarm. (Damon is one of the co-founders of Roc-A-Fella Records, alongside Jay-Z.) Roc-A-Fella swiftly halted the sale by filing a lawsuit in New York’s Southern District Court, arguing that the rights to Reasonable Doubt belong to the label, not Dash, and that Dash “can’t sell what he doesn’t own.” Dash has since responded that he was planning to sell only his one-third share of the album, by way of his one-third ownership of the record label, but Roc-A-Fella maintains that Dash has no legal right to do so, and a letter from Roc-A-Fella’s lawyers helped ensure cancellation of the auction for the time being.

Jay-Z himself is no stranger to NFTs. He and other members of Roc-Nation are investors in the NFT platform Bitski, which raised nearly $20 million in capital during a series A funding round. With such significant celebrity involvement, there is no question that there is big interest — and potentially big earnings — in the NFT market. For those with the added bonus of an already established fan base, NFTs represent a major, lucrative opportunity. It just has to be done right or else the big guns will hire the big lawyers to sue.

Issues surrounding music rights have been and will continue to be a growing topic of importance in the industry. Major artists have been announcing sales (even partial sales) of their catalogs to investors, a similar type of transaction that involves a precise understanding of what music rights entail. In May of 2021, for example, The Red Hot Chili Peppers sold their music publishing rights, in a deal reportedly worth $140 to 150 million, to British investment firm Hipgnosis. Leading up to and during a transaction like this, the artists have advocates, such as lawyers and publishing companies, who can advise on what type of returns particular rights might yield (in the way of royalties), what a fair market value (FMV) is for a catalog (accounting for multiples based on future earnings) and what artists can still keep even if they sell their publishing rights.

Advisors, and advocates for protection, must evolve as digital transactions evolve. If musicians create NFTs that include the various multiple rights that accompany music properties, then publishing companies, traditional advocates for music creators, will need to quickly get up to speed on what information is stored in an exchange, indicating what is sold and what is retained.

The same evolution is necessary for the new breed of collector who will be purchasing music NFTs. Buyers should carefully read the terms and conditions of any sale and, even then, should be cautious. Just because an artist wishes to sell their work as an NFT does not mean that the artist is clear on whether they have the legal right to do so. Even the legitimate purchase of an NFT will not automatically transfer copyright ownership — though in some circumstances, it could. Another factor to consider when contemplating a purchase is that different cryptocurrency platforms will treat NFT resale royalties differently, and these conditions are still evolving.

While the growing trend of NFTs in music can create tremendous opportunities for artists, and excitement for buyers, all must be cautious about potentially convoluted copyright issues that could emerge.

____

Corey Martin is Managing Partner and Chairman of the Entertainment Finance Department at Granderson Des Rochers LLP (“GDR”), an entertainment and media focused law firm with offices in Beverly Hills, California, and New York, New York.